Introduction

Imagine kijiye, aapne Nifty mein ek strong bullish move predict kiya, Call buy kiya, aur Nifty upar bhi gaya—lekin sirf 30 points. Agle 2 ghante market wahi khada raha aur aapka premium badhne ke bajaye kam ho gaya. Ye Theta Decay ka dard har beginner trader ne mehsoos kiya hai. Sabse badi frustration tab hoti hai jab aapka “Direction” sahi ho par fir bhi loss ho jaye.

Confusion tab aur badh jati hai jab log Iron Condor Option Strategy ke 4-legged structure ko dekhte hain. “Itne saare strikes kyun? Margin kitna lagega? Agar market crash ho gaya toh?” Ye sawal ek beginner ko panic mein dal dete hain.

Solution hai Iron Condor Strategy. Ye strategy aapko direction ki chinta se azad karti hai aur “Time” ko aapka dost banati hai. Is deep-dive guide mein hum textbook definitions ko chod kar Nifty 26,000 ke real-market levels par focus karenge. Main waada karta hoon ki article ke khatam hone tak, aap sirf strategy nahi, balki uske peeche ka Institutional Logic aur Adjustment Mechanics bhi seekh jayenge.

Kya aap jaante hain ki 80% waqt market sideways rehta hai ? Toh hum 100% waqt directional trading karke loss kyun jhelte hain?

Iron Condor Option Strategy Kya Hoti Hai? (The 4-Legged Structure)

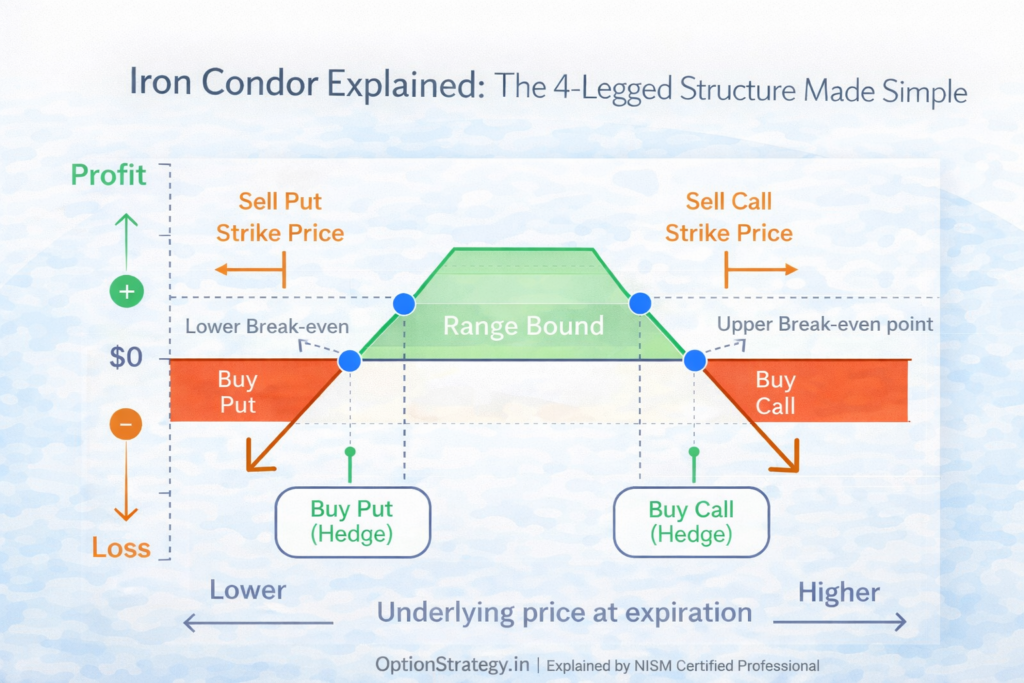

Iron Condor ek Limited Risk, Limited Reward strategy hai. Asal mein ye do Credit Spreads ka combination hai: ek Bear Call Spread aur ek Bull Put Spread. Iska core logic ye hai ki hum market ke upar aur niche jane ki ek “Boundary” set kar dete hain.

Iron Condor Ka Basic Structure Simple Hinglish Me

Jab aap ek Iron Condor deploy karte hain, toh aap basically market ko keh rahe hain: “Bhai, tu 25,700 ke niche mat jana aur 26,300 ke upar mat jana, beech mein kahi bhi expire ho ja, mujhe mera profit mil jayega.”

Iron Condor Execution Blueprint

Jab Nifty 26,000 par trade kar raha ho, toh ek balanced Iron Condor setup kuch is tarah dikhega. Hum yahan ₹200 points ka spread (difference between sell and buy) lekar chal rahe hain:

Step 1: The Put Side (Bull Put Spread)

- Sell: 25,800 PE (200 points OTM) → ₹50 Receive kiya

- Buy: 25,600 PE (Protection/Hedge) → ₹15 Pay kiya

- Net Income from Puts: ₹50 – ₹15 = ₹35

Step 2: The Call Side (Bear Call Spread)

- Sell: 26,200 CE (200 points OTM) → ₹45 Receive kiya

- Buy: 26,400 CE (Protection/Hedge) → ₹10 Pay kiya

- Net Income from Calls: ₹45 – ₹10 = ₹35

Step 3: Combined Strategy Outcome (Final Math)

| Component | Calculation Details | Final Value |

| Total Premium Collected | ₹50 (Put) + ₹45 (Call) | +₹95 |

| Total Premium Paid (Insurance) | ₹15 (Put) + ₹10 (Call) | -₹25 |

| Net Credit (Your Max Profit) | ₹95 – ₹25 | ₹70 Per Unit |

| Max Profit Per Lot (Qty: 65) | ₹70 x 65 | ₹4,550 |

| Max Risk (Worst Case) | (Spread Width – Net Credit) x Qty | (200 – 70) x 65 = ₹8,450 |

Ise Behtar Tarike se Present Karne ka “Pro Tip”:

Aap article mein is math ke turant baad ek Logic Check box add kar sakte hain:

💡 Logic Check for Beginners:

Aapka total profit (₹1,750) tab hoga jab Nifty 25,800 aur 26,200 ke beech expire hoga. Aapki range actually thodi aur badi hai (Breakevens), kyunki aapne ₹70 ka premium pocket mein rakha hai.

- Upper Breakeven: 26,200 + 70 = 26,270

- Lower Breakeven: 25,800 – 70 = 25,730

Lekin bahut se log confuse hote hain ki kya ye Iron Fly se behtar hai? Agle section mein ye mystery solve karte hain.

Iron Condor Aur Iron Fly Me Core Difference Kya Hai?

Ye dono strategies Non-Directional hain, lekin inka temperament alag hai. Beginner ke liye ye decision lena critical hota hai ki use kab konsi strategy choose karni chahiye.

Strike Selection Logic Ka Difference

- Iron Fly: Aap At-the-money (ATM) strikes par focus karte hain (Jaise 26,000 ka hi Call/Put sell karna). Iska Risk-to-Reward ratio accha hota hai lekin range bahut narrow hoti hai.

- Iron Condor: Aap Out-of-the-money (OTM) strikes bechte hain. Iski Probability of Profit (POP) kafi high hoti hai (aksar 65% se upar).

Vega Sensitivity & Volatility

Iron Condor mein Vega (Volatility) ka impact Iron Fly ke muqable thoda kam hota hai. Agar market shant rehne wala hai (Low VIX), toh Condor aapko zyada “Peace of Mind” dega.

Setup toh samajh aa gaya, lekin market ki wo konsi condition hai jahan Iron Condor “Money Printing Machine” ki tarah kaam karti hai?

Iron Condor Option Strategy Kab Best Suitable Hoti Hai?

Har waqt Condor dalna capital ke liye khatarnak ho sakta hai. Ek professional trader hamesha Market Context dekhta hai.

Range-Bound Market Expectation

Jab Nifty ek Consolidation Phase mein ho ya kisi bade breakout ke baad shant ho gaya ho. Smart Money Concepts (SMC) ke hisab se agar market do major Liquidity Zones ke beech phasa hai, toh wahi best entry point hai.

Time Decay (Theta) Ka Role

Iron Condor ka asli engine Theta Decay hai. Jaise-jaise expiry kareeb aati hai, OTM options ki value tezi se girti hai. Weekly expiry (Tuesday/Wednesday) ko ye decay sabse zyada profitable hota hai.

Kya Indian market ka structure (Weekly Expiry) is strategy ko aur bhi lucrative banata hai? Chaliye check karte hain.

Indian Market Context: Nifty & Bank Nifty Mastery

Indian markets mein Weekly Expiry ki wajah se volatility aur decay ka ek unique pattern hota hai.

Weekly Expiry Structure

Nifty me, Tuesday Expiry ko Gamma Risk badh jata hai. Isliye, Advanced Traders aksar Thursday ya Friday ko Iron Condor deploy karte hain aur Monday sham tak profit book karke exit kar dete hain.

India VIX ka Impact

Agar India VIX 12-15 ke beech hai, toh market stable rehne ke chances zyada hote hain. Agar VIX 20 ke upar hai, toh premiums toh acche milenge par Gap-up/Gap-down ka darr hamesha rahega.

Setup perfect hai, market bhi shant hai… lekin agar achanak koi bad news aa jaye? Wahan aata hai “The Art of Adjustment.”

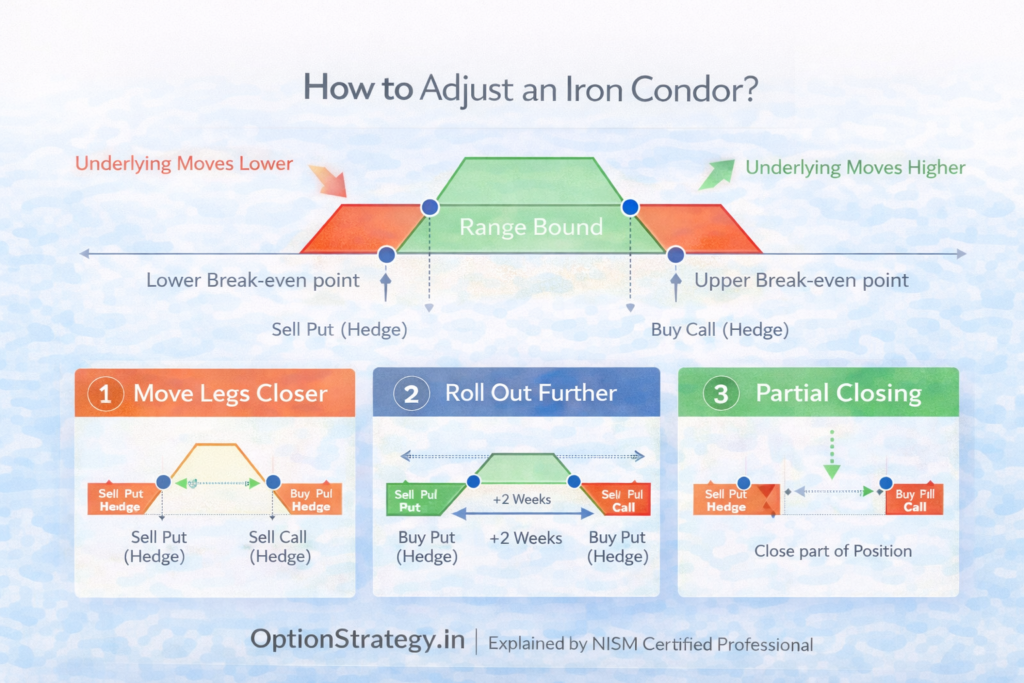

Adjustments: Agar Market Range Tod De Toh Kya Karein? (Firefighting)

Ye wo section hai jo aapko ek “Beginner” se “Professional” banayega. Iron Condor tab fail hoti hai jab aap market ke move hone par haath par haath dharke baithe rehte hain.

Rolling the Untested Side

Maana Nifty 26,000 se bhagkar 26,200 (aapki Call side) ke paas aa gaya.

- Problem: Call side mein loss dikhne lagega.

- Action: Aapka Put side (25,800 PE) ab poora safe hai. Is Put spread ko profit mein book karein aur use upar shift karke 26,000 ya 26,100 par le aayein.

- Logic: Extra premium collect karke aap apne Call side ke loss ko offset kar rahe hain. Isse kehte hain Delta Neutralization.

Stop Loss & Target Setting

- Target: Jab aapne collect kiya hua 50% premium decay ho jaye, toh trade se nikal jayein.

- Stop Loss: Agar market aapke Breakeven Point ko touch kare, toh zid na karein aur position exit karein.

In adjustments ke bawajud, beginners kuch aisi galtiyan karte hain jo poora capital saaf kar deti hain.

Iron Condor Strategy Ke Common Beginner Mistakes

- Chasing Low Premiums: Bahut dur ke strikes (OTM) bechna jahan sirf ₹2 mil rahe hon. Ismein risk/reward bilkul galat ho jata hai.

- Over-Position Sizing: Kyunki Margin Benefits milte hain, log apni capacity se zyada lots bech dete hain.

- Ignoring Events: Budget day ya RBI Policy jaise Economic Event se pehle Condor dalna suicide ke barabar hai kyunki IV Expansion aapka stop-loss uda degi.

Summary:

Iron Condor ek powerful weapon hai, lekin isse “Trending Market” mein use nahi karna chahiye. Agar Nifty ek Institutional Order Block se breakout de raha hai, toh wahan non-directional hona bewaqufi hai.

Strategic Summary:

- Best Time: High IV ke baad jab market shant ho (IV Crush).

- Best Tool: Delta (0.15 – 0.20) strikes select karein.

- Primary Goal: Capital protection aur Theta decay gain karna.

Apne base ko aur mazboot karne ke liye, hamara main Non-Directional Option Strategy for Beginners pillar page dobara padhein taaki aapko saari strategies ka comparison samajh aa jaye.

FAQs: Iron Condor Deep-Dive

Hedging (Wings buy karne) ki wajah se, Nifty mein ek lot Iron Condor approx ₹50,000 – ₹60,000 mein ban jata hai.

Nahi. Iron Condor ko ek single strategy ki tarah treat karein. Pura combo dekhein aur Combined MTM (Mark to Market) par stop-loss rakhein.

Gap-up mein adjustments mushkil hote hain, isliye hamesha Defined Risk (Wings) ke sath hi trade karein taaki overnight risk control mein rahe.

Zyadatar traders Friday sham ya Monday subah enter karte hain taaki weekend ka Theta Decay unhe mil sake.

Realistic expectations 2-4% per month ki honi chahiye. 10% ke liye aapko bahut zyada risk lena padega, jo beginner ke liye safe nahi hai.