Introduction

Kya aapne kabhi socha hai ki jab market ek hi jagah khada rehta hai, tab sabse zyada paisa kaun banata hai? Ek beginner trader aksar tab pareshan hota hai jab Nifty 26,000 ke level par aakar “Stuck” ho jata hai. Aap Call buy karte hain toh market niche gir jata hai, aur Put buy karte hain toh wahi se bounce ho jata hai. Ye Sideways Market ka trap hi hai jo 90% retailers ka capital kha jata hai.

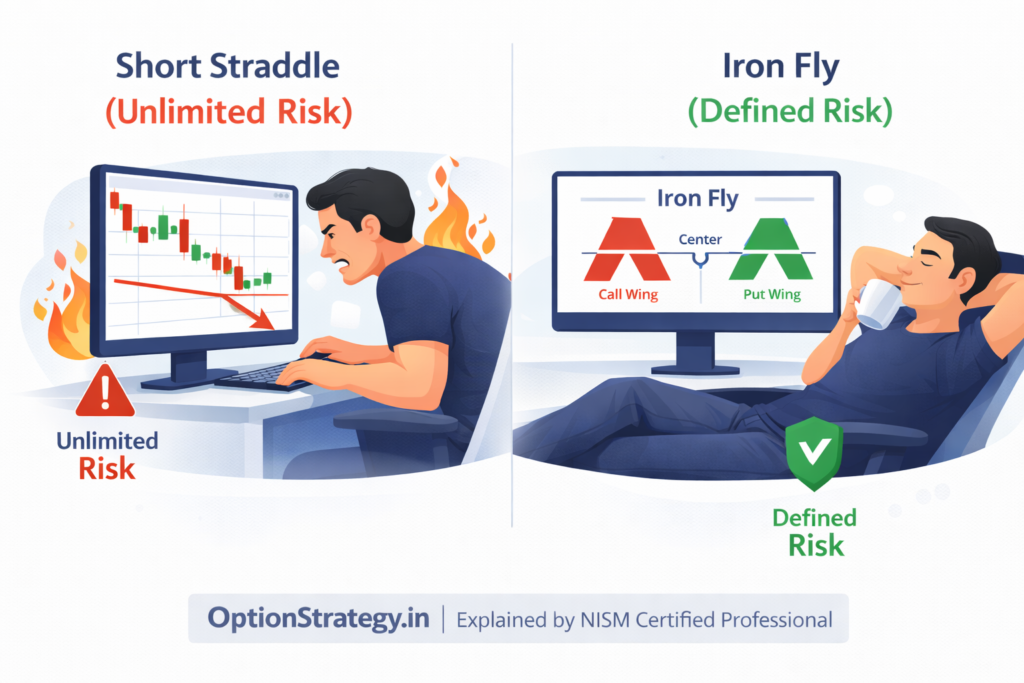

Confusion tab shuru hoti hai jab aap Short Straddle jaise setups ke bare mein sunte hain jahan “Unlimited Risk” hota hai. Beginners dar jaate hain ki agar market mein koi bada gap-up ya gap-down ho gaya toh unka account saaf ho jayega.

Yahan solution bankar aati hai Iron Fly Option Strategy. Ye ek aisi strategy hai jo aapko sideways market ka fayda toh deti hai, lekin ek Fixed Risk ke “Safety Net” ke sath. Is article mein hum textbook theory ko side rakh kar seekhenge ki kaise Institutional Money ki tarah ek limited-risk boundary set ki jati hai. Main waada karta hoon ki is deep-dive ke baad, aapko Iron Fly sirf ek strategy nahi, balki ek disciplined business model lagegi.

Agar market 80% time sideways rehta hai, toh aap abhi bhi breakout ka intezar kyun kar rahe hain? Kyun na us 80% move ko hi apna profit banaya jaye?

Iron Fly Option Strategy Kya Hoti Hai? (The Balanced Wing Structure)

Iron Fly ek Market Neutral aur Defined Risk strategy hai. Iska structure ek “Butterfly” ki tarah dikhta hai jahan center mein bada profit aur side mein limited loss hota hai.

Iron Fly Ka Basic Structure Simple Language Me

Technical terms mein, ye ek At-the-money (ATM) Straddle ko OTM wings ke sath hedge karke banayi jati hai.

- Aap current price (CMP) ka ek Call aur ek Put sell karte hain (Short Straddle).

- Usi waqt, kuch dur ke Call aur Put buy karte hain (Long Wings).

Iron Fly vs Short Straddle: Core Difference

Short Straddle mein aapka risk unlimited hota hai. Agar Nifty 26,000 se achanak 25,000 chala jaye, toh Straddle trader barbad ho sakta hai. Lekin Iron Fly mein aapne “Wings” buy kiye hain, isliye aapko pehle se pata hota hai ki “Worst Case” mein aapka kitna loss hoga.

Iron Fly Non-Directional Strategy Kyun Mani Jati Hai?

Is strategy ka poora logic Delta Neutrality par tika hai. Aap market ko ye keh rahe hain ki “Mujhe nahi pata market kahan jayega, par mujhe lagta hai ye isi level ke aas-paas expire hoga.”

Non-Directional trading ke base ko samajhne ke liye hamara Best Non-Directional Option Strategies: The Ultimate A-Z Guide for Beginners 2026 is pillar page dekhein.

Market Neutral Expectation Ka Role

Jab Nifty 26,000 par trade kar raha ho aur wahan heavy Call Writing aur Put Writing dono dikh rahi ho (NSE Option Chain data), tab ye strategy deploy ki jati hai. Aapka goal hota hai Theta Decay (Time value) ko capture karna.

Range-Bound Market Logic

SMC (Smart Money Concepts) ke mutabiq, jab market do bade Institutional Order Blocks ke beech consolidate karta hai, tab price “Mean Reversion” follow karti hai. Iron Fly isi consolidation ka maximum fayda uthati hai.

Setup toh samajh aa gaya, lekin Nifty 26,000 par iski exact calculation kya hogi? Chaliye math dekhte hain.

Deep Execution: Nifty 26,000 Iron Fly Blueprint (Lot Size: 65)

Chaliye, real numbers ke sath dekhte hain ki ek ideal Iron Fly kaise deploy ki jati hai jab Nifty 26,000 par ho.

Step 1: The ATM Straddle (Selling the Core)

- Sell 26,000 CE @ ₹150

- Sell 26,000 PE @ ₹140

- Total Premium Received: ₹290

Step 2: The Wings (Buying Protection)

- Buy 26,300 CE (300 points OTM) @ ₹35

- Buy 25,700 PE (300 points OTM) @ ₹30

- Total Premium Paid: ₹65

Step 3: Final Execution Math

| Component | Calculation Details | Final Value (Per Unit) |

| Total Credit (Collected) | ₹290 (Straddle Premium) | +₹290 |

| Total Debit (Hedge Cost) | ₹65 (Wings Cost) | -₹65 |

| Net Credit (Max Profit) | ₹290 – ₹65 | ₹225 |

| Max Profit Per Lot | ₹225 x 65 (Lot Size) | ₹14,625 |

| Max Risk (Per Unit) | (Spread Width 300 – Net Credit 225) | ₹75 |

| Max Risk Per Lot | ₹75 x 65 | ₹4,875 |

Risk-to-Reward Ratio: Approx 1 : 3 (Har ₹1 risk par ₹3 ka potential reward).

Is behtareen R:R ratio ke bawajud, market toh move karega hi. Toh jab market range se bahar nikalne lage, tab firefighting (adjustments) kaise karein?

Adjustments & Firefighting: Agar Market Range Tod De

Iron Fly mein entry lena asaan hai, lekin Management hi ek pro-trader ko beginner se alag karti hai.

Scenario: Nifty 26,000 se 26,200 par aa gaya

Jab market ek side bhagne lage, toh aapki “Untested Side” (is case mein Put side) sasti ho jayegi.

- Action: 26,000 PE (Sold) ko profit mein book karein aur use upar shift karke 26,100 ya 26,150 par le aayein.

- Benefit: Isse aapko extra premium milega jo aapke Call side ke loss ko kam kar dega. Isse aapki strategy Iron Fly se Iron Fly with Shifted Delta ban jayegi.

Stop Loss Rule

Agar Nifty aapke Breakeven Points (Upper: 26,225 | Lower: 25,775) ko cross karke hold karne lage, toh adjustments band karein aur capital bachane ke liye exit karein.

Indian Market Context & Weekly Expiry Behaviour

India mein Nifty Weekly Expiry Iron Fly ke liye ek “Double-Edged Sword” hai.

- Theta Acceleration: Tuesday aur Wednesday ko decay bohot fast hota hai. Agar Nifty 26,000 ke paas shant hai, toh aapka profit graph tezi se upar jayega.

- Gamma Burst: Thursday (Expiry Day) ko Iron Fly bohot risky hoti hai. Ek chota sa move bhi aapka poora profit zero kar sakta hai.

- Pro Tip: Hamesha Wednesday sham tak ya Thursday subah tak position close karne ka target rakhein.

Iron Fly Ke Common Beginner Mistakes

- Low Volatility Entry: Jab India VIX bohot low ho (10-11), tab premiums kam milte hain. Aise mein Iron Fly ka Risk-to-Reward kharab ho jata hai.

- Over-Optimism: Beginners sochte hain ki exact center (26,000) par hi expire hoga. Reality ye hai ki aapko center ke paas aate hi profit book karna chahiye.

- Hedges ko ignore karna: Margin bachane ke liye bina wings ke straddle bechna “Account Suicide” ho sakta hai.

Summary: Iron Fly Kab Avoid Karein?

Iron Fly tab avoid karni chahiye jab:

- Market Strong Trend mein ho (High-low pattern breakout).

- Koi major Event (Budget, Election, Global News) aane wala ho.

- India VIX sudden spike hone ke chances hon (Vega Risk).

Strategic Conclusion:

Iron Fly Non-Directional Option Strategy un traders ke liye hai jo Risk Management ko ROI se zyada priority dete hain. Ye strategy aapko disciplined banati hai kyunki ismein emotions ke liye jagah kam aur calculations ke liye zyada hoti hai.

Agar aapko lagta hai ki Iron Fly ki range bohot narrow hai, toh hamara or aapko ek wide range chahiye to Iron Condor Option Strategy Beginner guide dekhein, jahan hum seekhte hain ki wide range mein income kaise banayi jati hai.

FAQs: Iron Fly Deep-Dive

Hedged hone ki wajah se, Nifty (65 lot size) mein ek Iron Fly approx ₹55,000 – ₹70,000 ke margin mein ban jati hai.

Agar aapko bada profit kam range mein chahiye, toh Iron Fly. Agar aapko chota profit par badi safety range chahiye, toh Iron Condor.

Ji haan, lekin ise Systematic Trading ki tarah deploy karna hoga, jahan aapka focus monthly 3-5% return par ho, na ki har trade mein jackpot par.

Jab market aapke Sold Strikes se approx 0.5% door ho jaye ya Delta imbalance badh jaye, tab adjustments start karne chahiye.

Max loss tab hota hai jab market aapke buy kiye hue Wings (26,300 ya 25,700) ke bhi bahar nikal jaye. Lekin ye loss pehle se fixed hota hai.

बेहतरीन….. शुरुआती समझ के लिए विस्तृत विश्लेषण।

Thank You Omprakash Ji…