1. Introduction

Market mein naye aane wale har trader ka ek hi sapna hota hai—”Consistency.” Aur jab baat consistency ki aati hai, toh Short Strangle Option Strategy ka naam sabse upar aata hai. Beginners ko ye strategy isliye attractive lagti hai kyunki ismein aapko “Hath-paer” maarne ki zaroorat nahi padti. Agar Nifty 26,000 par hai, toh aap door ke strikes bech kar aaram se baith sakte hain.

Lekin, ye “Aaram” aksar ek trap ban jata hai. Beginners ko lagta hai ki market kabhi 500-600 points move nahi karega, par jab Tuesday Expiry ke din achanak koi global news aati hai, tab ye “Attractive” strategy sabse bada dushman ban jati hai. Is article mein hum iske attraction aur iske peeche chupe real-market risks dono ko decode karenge.

Promise: Is deep-dive ke baad, aapko pata hoga ki door ke premiums bechna kab “Smart” hai aur kab “Suicide.”

Kya aap jaante hain ki Short Strangle ki Probability of Profit (POP) 70% se zyada ho sakti hai? Par kya wahi 30% loss aapka poora capital saaf karne ke liye kaafi hai?

2. Short Strangle Option Strategy Kya Hoti Hai?

Short Strangle ek non-directional Option strategy hai jahan ek trader do alag-alag Out-of-the-money (OTM) strikes ko sell karta hai.

Non-Directional trading ke base ko samajhne ke liye hamara Best Non-Directional Option Strategies: The Ultimate A-Z Guide for Beginners 2026 is pillar page dekhein.

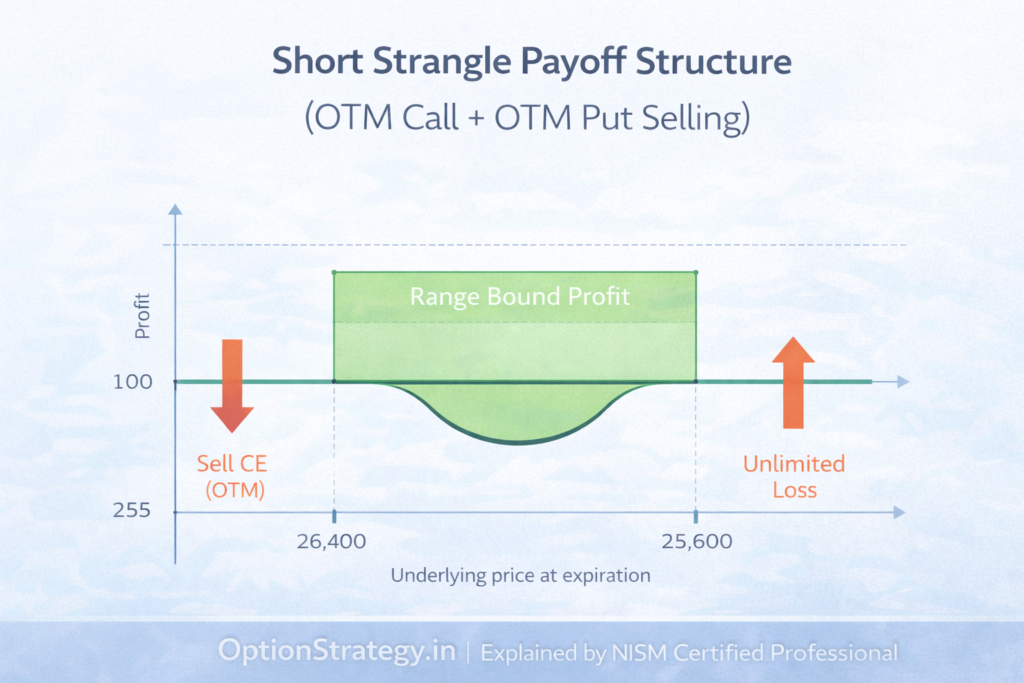

2.1 Short Strangle Ka Basic Structure Simple Hinglish Me

Imagine kijiye Nifty 26,000 par hai. Aapko lagta hai ki is hafte market shant rahega.

- Aap upar ki taraf 26,400 CE sell karte hain.

- Aap niche ki taraf 25,600 PE sell karte hain.

Aapne basically market ke liye ek 800-point ki “Laxman Rekha” khinch di hai. Jab tak Nifty is range ke andar hai, aap profit mein hain.

2.2 Short Strangle Ka Non-Directional Nature Kaise Work Karta Hai?

Iska kaam karne ka tarika hai Time Decay (Theta). Kyunki aapne door ke options beche hain, unmein sirf “Time Value” hoti hai. Jaise-jaise Tuesday Expiry paas aati hai, wo value zero hone lagti hai. Ismein aapko ye predict nahi karna ki market kahan jayega, balki ye batana hai ki market kahan nahi jayega.

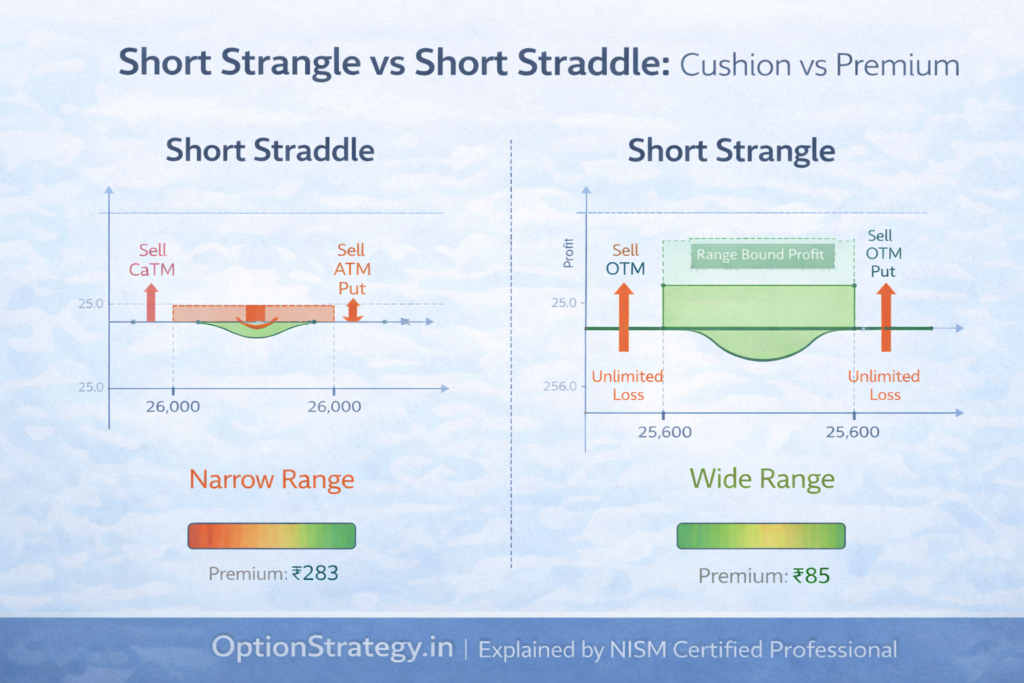

3. Short Strangle Vs Short Straddle Me Core Difference Kya Hai?

Dono hi non-directional hain, lekin inka “DNA” alag hai.

3.1 Strike Distance Ka Role

- Short Straddle: Aap ATM (At-the-money) bechte hain (e.g., 26,000 PE/CE). Yahan premium bohot zyada milta hai par range bilkul nahi milti.

- Short Strangle: Aap OTM (Out-of-the-money) bechte hain. Yahan premium kam milta hai par aapko market ke move hone ke liye bohot badi “Cushion” (Safety gap) milti hai.

3.2 Risk Profile Aur Margin Difference

Straddle mein thoda sa move bhi darr paida karta hai, par Strangle mein aap 100-200 point ke move ko ignore kar sakte hain. Margin Requirement dono mein lagbhag same hoti hai (approx ₹2.5L – ₹2.8L per lot) kyunki dono hi Naked Option Selling hain.

4. Deep Execution: Nifty 26,000 Short Strangle Blueprint (Lot Size: 65)

Chaliye, Tuesday Expiry ke liye calculation dekhte hain.

The Execution Blueprint:

- Nifty CMP: 26,000

- Sell 26,300 CE (OTM) @ ₹45

- Sell 25,700 PE (OTM) @ ₹40

Final Math Table:

| Component | Calculation Details | Final Value |

| Total Premium Collected | ₹45 (CE) + ₹40 (PE) | +₹85 |

| Max Profit Per Unit | ₹85 (If ends between 25,700-26,300) | ₹85 |

| Max Profit Per Lot | ₹85 x 65 (Lot Size) | ₹5,525 |

| Upper Breakeven | 26,300 + 85 | 26,385 |

| Lower Breakeven | 25,700 – 85 | 25,615 |

| Max Risk | Theoretical Unlimited | Requires Discipline |

5. Indian Market Context: Short Strangle Kaise Fit Hoti Hai?

India mein Index Options (Nifty / Bank Nifty) ki liquidity ise har trader ki favourite strategy banati hai.

5.1 Weekly Expiry Structure & Theta Decay

Nifty ki expiry Tuesday ko shift hone ke baad, Monday ko premiums tezi se “Crush” hote hain. Professional traders aksar Friday sham ko door ke strikes bech kar weekend ka Theta Decay capture karte hain.

5.2 Index Behaviour

Nifty 26,000 jaise bade levels par aksar “Sideways” move karta hai. Jab tak koi badi institutional news (SMC) na aaye, Nifty ek broad range hold karta hai, jo Strangle sellers ke liye jackpot hai.

6. Short Strangle Ka Risk–Reward Reality Check

Yahan sabse bada “Myth” hai high probability ka.

- Unlimited Loss: Iska matlab hai ki agar market crash ho jaye, toh aapka ₹40 ka Put ₹400 bhi ho sakta hai.

- High Probability Myth: Beginners sochte hain ki “90% chance hai jeetne ka.” Par yaad rakhiye, wo 10% baar jo market range todega, wo aapka pichle 5 mahine ka profit le ja sakta hai.

Agar market range tod de, toh kya baith kar sirf pray karna chahiye? Nahi, wahan Adjustment Strategies kaam aati hain.

7. Short Strangle Strategy Ke Common Beginner Mistakes

- Tight Strikes Choose Karna: Sirf ₹10-20 extra ke liye 26,100 ka Call bechna jab Nifty 26,000 par ho. Isse aapki safety range khatam ho jati hai.

- No Adjustment Plan: Log sochte hain “Dekha jayega.” Par jab Nifty 26,300 hit karta hai, tab dimaag kaam nahi karta. Hamesha Non-Directional Risk Management plan ke sath enter karein.

- Low IV Selling: Jab India VIX 10-11 ho, tab premiums itne kam hote hain ki risk lene ka koi fayda nahi hota.

8. Kis Type Ke Trader Ke Liye Suitable Hai?

- Working Professionals: Ye unke liye best hai jo screen nahi dekh sakte. 300-400 point ki range kafi safety deti hai.

- Capital Size: At least ₹3-5 Lakh per lot taaki aap Adjustments ke liye extra margin handle kar sakein.

- Full-Time Traders: Wo isse “Straddle” mein convert karke extra profit nikal sakte hain.

9. Summary: Short Strangle Kab Avoid Karein?

- Jab Tuesday Expiry se pehle koi bada event (Budget, Election) ho.

- Agar India VIX achanak spike ho raha ho (Vega Risk).

- Jab market ek “Strong Trending” mode mein ho (SMC Breakout).

Strategic Conclusion:

Short Strangle unke liye hai jo “Chote-Chote” par consistent profits chahte hain. Lekin ismein master banne ke liye aapko apne greed (lalach) par control karna hoga. Agar aapko naked selling se darr lagta hai, toh hamara Iron Condor Option Strategy 2026: Beginner Guide for Consistent Income dekhein jo Strangle ka hedged (safe) version hai.

Apne base ko aur mazboot karne ke liye, hamara main Non-Directional Option Strategy for Beginners pillar page dobara padhein taaki aapko saari strategies ka comparison samajh aa jaye.

Tools & Platforms for Short Strangle Option Strategy

Range-based option strategies jaise Short Strangle me success kaafi had tak right tools par depend karta hai. Neeche diye gaye tools aapko strike selection, risk analysis, adjustment planning aur volatility tracking me help karte hain.

Options Strategy Builder & Payoff Analysis Tools

Ye tools aapko Short Strangle ka payoff chart, max profit, max loss aur breakeven levels clearly dikhate hain.

- Sensibull – Strategy builder, payoff graph, Greeks aur adjustment simulation ke liye popular tool

- Opstra – Advanced option chain analysis, probability metrics aur volatility insights

👉 In tools ke bina Short Strangle blindly execute karna avoid karein.

Implied Volatility (IV) & Market Sentiment Tools

Short Strangle hamesha high IV environment me better kaam karta hai. Isliye IV analysis critical hai.

- NSE India Option Chain – Live IV data aur open interest change dekhne ke liye

- TradingView – India VIX, index structure aur range confirmation ke liye charts

Economic Events & Volatility Risk Tracking

Range-based strategies me event risk sabse bada enemy hota hai.

- Investing.com Economic Calendar – Major events (policy, inflation, global cues) track karne ke liye

- Moneycontrol – News + market sentiment overview

🔹 Broker Platforms (Execution & Margin Check)

Correct margin estimation aur fast execution ke liye broker tools ka use zaroori hai.

- Zerodha – Margin calculator aur order execution

- Upstox – Option chain view aur basket order execution

Important Note

Tools sirf decision-making ko better banate hain, profit guarantee nahi. Final entry, exit aur risk management trader ki responsibility hoti hai.

FAQs: Short Strangle Non-Directional Option Strategy

Strangle, Straddle se safer hai kyunki range badi milti hai, lekin “Naked Selling” hone ki wajah se ismein black-swan events ka risk hamesha rehta hai.

Straddle mein same ATM strike (e.g., 26,000) bechi jati hai, jabki Strangle mein door ke alag-alag OTM strikes (e.g., 25,700 aur 26,300) beche jate hain.

Ji haan, Tuesday Expiry ke liye Monday aur Tuesday ko ismein kafi accha Theta decay milta hai.

Kyunki options ko buy karne ki koi limit nahi hai, agar market kisi ek side tezi se bhage toh sold option ka premium kitna bhi upar ja sakta hai.

High volatility ka matlab hai market bade swings dega, jo aapki set ki hui range ko asani se tod sakta hai.

Bahut hi badiya tareeke se samjhaya h aapne.

Thank You Sunil ji.