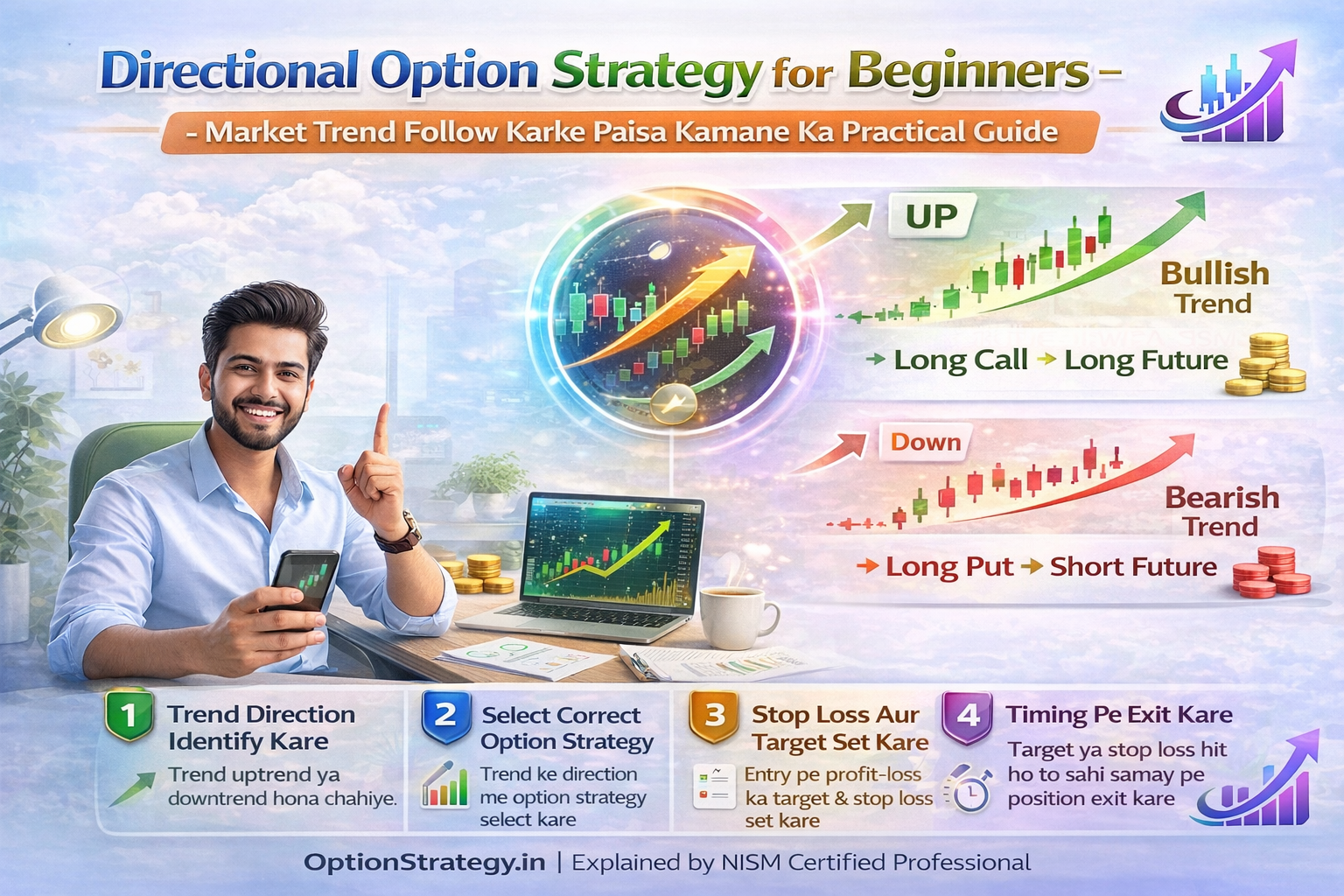

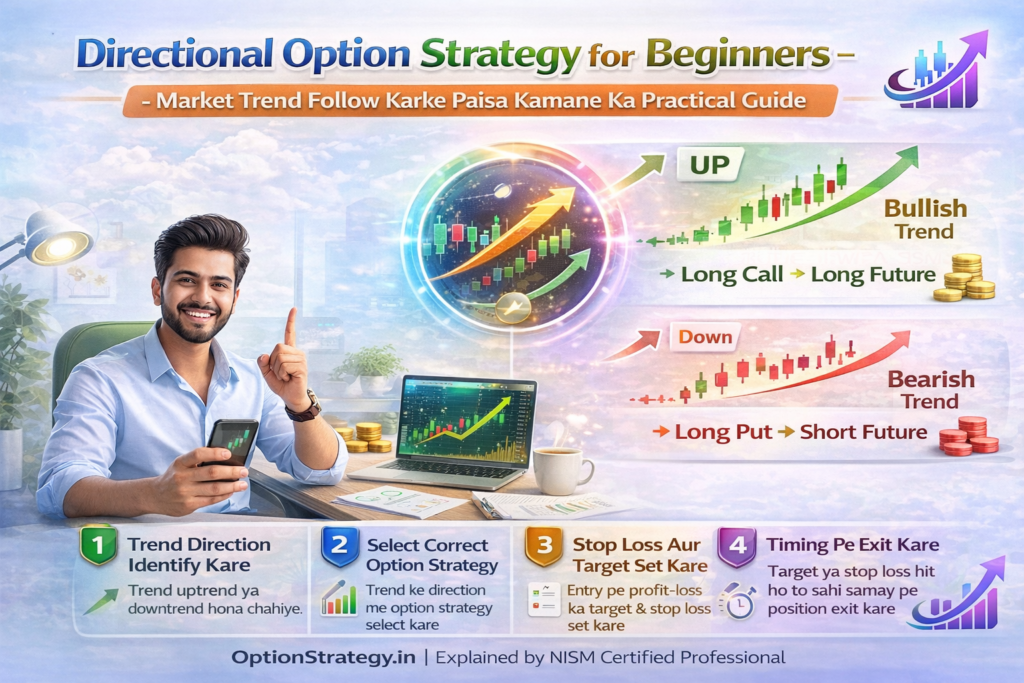

1. Introduction

Trading ki shuruat mein har kisi ka dimag ek hi tarah se kaam karta hai—”Nifty upar jayega ya niche?” Ye sawal jitna simple lagta hai, iska jawab utna hi complex hai. Beginners ko Directional Option Strategy isliye pasand aati hai kyunki ye hamare natural logic (Upar = Buy, Niche = Sell) se match karti hai. Jaise Nifty kisi bade psychological level (jaise 26000) ko cross karta hai, toh har koi us momentum ko catch karna chahta hai.

Lekin, yahi wo jagah hai jahan 90% beginners fail hote hain. Unhe lagta hai ki agar market unki direction mein gaya, toh profit pakka hai. Asal mein, options ki duniya mein direction sahi hona sirf aadhi jung jeetna hai. Baaki aadhi jung Option Greeks, Volatility, aur Strategy Selection par nirbhar karti hai. Is guide mein hum “Naked Buying” ke darr ko khatam karke Defined Risk Spreads ka ek solid foundation banayenge.

1.1 “Market upar jayega / niche jayega” soch beginners ko kyun simple lagti hai?

Beginners ko lagta hai ki trading sirf ek “Guessing Game” hai. Agar unhone Call kharida aur market 100 point upar gaya, toh unhe lagta hai ki wo expert ban gaye. Ye simplicity hi unka sabse bada dushman hai kyunki wo Institutional Intent (SMC) aur Liquidity Traps ko nahi samajhte jo aksar fake breakouts create karte hain.

1.2 Direction sahi hone ke baad bhi beginners ko loss kyun hota hai?

Kya aapke saath aisa hua hai ki aapne Call liya, Nifty upar bhi gaya, par aapka premium nahi badha? Iska karan hai Theta Decay (Time Value) aur IV Crush. Agar aapki timing galat hai, toh market sahi direction mein hote hue bhi aapka capital saaf kar dega. Directional trading mein aapka dushman sirf galat direction nahi, balki “Waqt” bhi hai.

Kya aap jaante hain ki bina strategy ke directional bet lagana gambling hai, lekin ek Bull Call Spread ke saath wahi bet ek professional business ban jata hai?

2. Directional Option Strategy ka Matlab Kya Hota Hai?

Directional trading ka matlab hai ek aisi planning jahan aapka profit market ke ek specific side move karne par depend karta hai. Ye Non-directional trading se bilkul ulti hai.

2.1 Directional vs Non-Directional Option Strategy: Core Difference

Non-directional Option Strategy mein hum market ke ek range mein rukne ka intezar karte hain, lekin Directional Option Strategy mein humein Momentum chahiye hota hai. Agar market 26,000 par hi khada reh jaye, toh ek directional trader loss karta hai jabki non-directional trader profit banata hai.

2.2 Prediction, Timing aur Volatility ka Role

Yahan sirf prediction kafi nahi hai. Aapko ye bhi pata hona chahiye ki move kab aayega. Nifty 26,000 par ho aur aapka target 26,200 ho, toh wo target Tuesday Expiry se pehle aana zaroori hai. Iske saath hi Implied Volatility (IV) ka badhna aapke favor mein hota hai agar aapne options buy kiye hain.

Lekin kya aapka “Directional View” hi profit ki guarantee hai? Chaliye iska reality check karte hain.

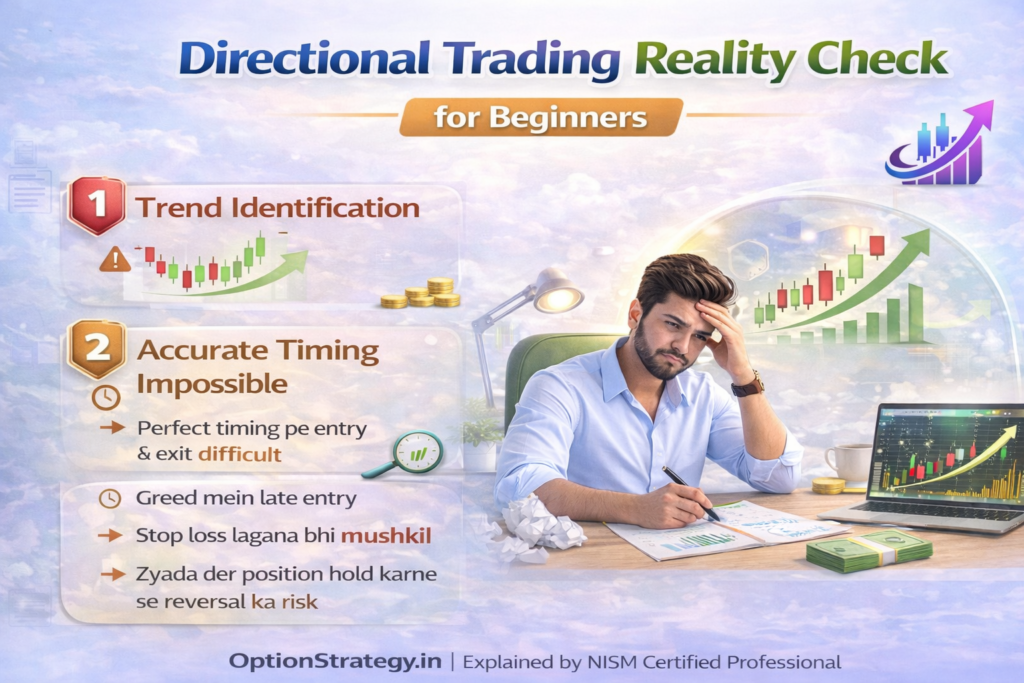

3. Beginners ke Liye Directional Trading ka Reality Check

Options trading mein “Right but Wrong” hona bohot common hai. Aap direction mein sahi ho sakte hain, par fir bhi loss mein exit kar sakte hain kyunki aapne strategy galat chuni thi.

3.1 Sirf direction sahi hona profit ke liye kyun enough nahi hota?

Jab aap Call ya Put buy karte hain, toh aap premium pay karte hain. Agar market dheere-dheere aapki direction mein jata hai, toh Time Decay aapke profit se zyada tezi se premium ko kam kar deta hai. Isse bachne ke liye beginners ko Spread Trading seekhni chahiye.

3.2 Greeks aur Time Decay ka Impact

Directional trades mein Delta aapka dost hai, lekin Theta aapka sabse bada dushman. Agar aap Nifty 65 lot size ke saath naked options buy kar rahe hain, toh har guzarta ghanta aapke capital ko khatam kar raha hai. Spread banane se aapka Theta loss sell kiye huye option se recover ho jata hai.

4. “Best Directional Strategy” ka Matlab Beginners ke Liye Kya Hai?

“Best” wo nahi hai jo jackpot de, balki wo hai jo aapka account wipe-out hone se bachaye aur consistent return de.

- Controlled Directional Exposure: Beginners hamesha aggressive profit (Naked Buying) ki taraf bhagte hain. Lekin professional traders Defined-Risk Structures choose karte hain jahan unhe pata hota hai ki max loss kitna hai.

- Psychological Edge: Jab aapko pata hota hai ki Nifty agar 26,000 se 25,500 bhi gir jaye toh aapka loss ₹2000 se zyada nahi hoga, tab aap market mein shanti se tike rehte hain.

5. Market Kab Directional Option Strategies ke Liye Suitable Hota Hai?

Har waqt trend ride karne ki koshish karna over-trading ko janm deta hai. Sahi waqt ka intezar karna hi asli trading hai.

5.1 Trending Market vs Range-bound Market

Jab Nifty kisi major Support ya Resistance (SMC Order Block) ko break karta hai, tab ek directional trend shuru hota hai. Agar market ek narrow range mein hai, toh directional strategies loss degi kyunki wahan momentum missing hota hai.

5.2 Events, News aur Momentum

Results season, Budget, ya RBI Policy jaise events market mein Directional Momentum generate karte hain. Aise waqt mein spreads (Bull/Bear) sabse best work karte hain kyunki unhe move ki zaroorat hoti hai aur IV spike unke favor mein jata hai.

Ab aate hain main action par. Agar Nifty 26,000 se upar jane wala hai, toh aapke paas kaunse weapons hain?

6. Bullish Directional Option Strategies for Beginners (Overview)

Jab chart par Higher Highs ka pattern ban raha ho aur Nifty apne 26,000 jaise level ke support level se bounce kare, tab bullish strategies ka waqt hota hai.

6.1 Bull Call Spread – The Beginner’s Gold Standard

Ismein aap ek ATM Call buy karte hain aur uske badle ek OTM Call sell karte hain. Sell kiya hua Call aapki buying cost ko kam kar deta hai aur Theta Decay ke darr ko bhi khatam karta hai. Ye strategy tab best hai jab aapka view moderate bullish ho.

Cluster Post: Iske execution aur strike selection ke liye padhein [Bull Call Spread Strategy Explained].

6.2 Bull Put Spread – Bullish View with Higher Probability

Ye ek Credit Strategy hai jahan aap niche ke Puts sell karte hain aur protection ke liye aur niche ke Puts buy karte hain. Ismein aapko premium receive hota hai. Agar Nifty sideways bhi rahe, tab bhi aap profit banate hain.

Cluster Post: Ise master karne ke liye dekhein [Bull Put Spread Strategy Guide].

6.3 Bull Condor – Moderate Bullish View with Range Bias

Jab aapko lagta hai ki market upar jayega par ek limit tak, tab Bull Condor best hai. Ismein 4 legs hote hain aur ye ek defined profit window create karta hai. Ye beginners ke liye bohot hi safe strategy mani jati hai.

Cluster Post: Detailed roadmap ke liye check karein [Bull Condor Strategy for Beginners].

6.4 Bull Butterfly – Strong View with Low Cost

Agar aapka target fixed hai (e.g. Nifty @ 26,200), toh Butterfly sabse kam capital mein bada profit de sakti hai. Iska Risk-to-Reward ratio 1:5 tak ho sakta hai.

Cluster Post: Deep-dive ke liye padhein [Bull Butterfly Strategy Explained].

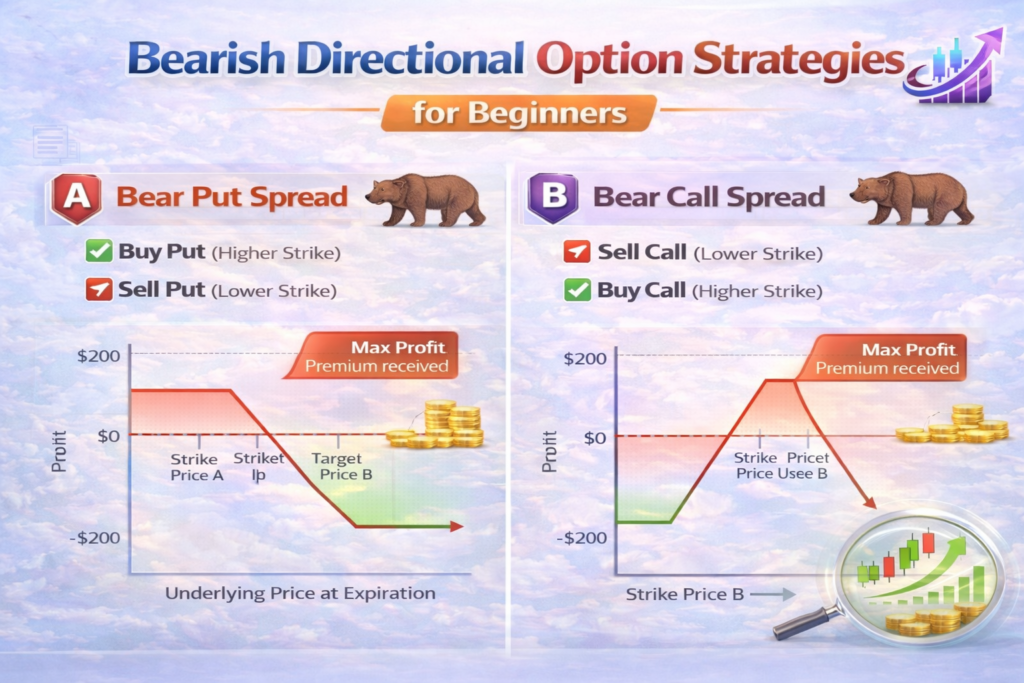

7. Bearish Directional Option Strategies for Beginners (Overview)

Jab market mein darr ka mahol ho aur Nifty apne resistance se niche girne lage, tab ye bearish strategies aapka capital bachati aur badhati hain.

7.1 Bear Put Spread – Classic Bearish Play

Ismein aap ek ATM Put buy karte hain aur ek OTM Put sell karte hain. Ye crash ya correction catch karne ka sabse safe tarika hai kyunki ismein naked buying ki tarah premium galne ka darr kam hota hai.

Cluster Post: Detailed execution ke liye dekhein [Bear Put Spread Strategy Explained].

7.2 Bear Call Spread – Bearish View with Time Advantage

Ye strategy tab use hoti hai jab aapko lagta hai market niche jayega ya sideways rahega. Upar ke Calls sell karke aap premium collect karte hain, jo market girne par aapka profit ban jata hai.

Cluster Post: Iske adjustments ke liye padhein [Bear Call Spread Strategy Guide].

7.3 Bear Condor – Moderate Bearish Bias

Agar market dheere-dheere niche gir raha hai, toh Bear Condor aapko limited risk mein ek acchi range deta hai. Ye strategy volatility ko kafi acche se handle karti hai.

Cluster Post: Check karein [Bear Condor Strategy for Beginners].

7.4 Bear Butterfly – Sharp Downside Target

Jab aapko lagta hai ki Nifty kisi specific level tak girega, toh Bear Butterfly use karein. Ye bohot sasti banti hai aur target hit hone par jackpot returns deti hai.

Cluster Post: Dekhe hamara guide [Bear Butterfly Strategy Explained].

8. Bull vs Bear: Beginners ke Liye Sahi Strategy Kaise Choose Karein?

Directional option trading me sabse badi galti beginners ye karte hain ki har market condition me same strategy use kar lete hain.

Sahi approach ye hoti hai ki market ke confidence aur speed (momentum) ke hisaab se strategy select ki jaye.

Is decision ko aasan banane ke liye market ko 2 simple categories me divide karein:

Case 1: High Confidence Move (Strong & Fast Momentum)

Market Situation

- Price strong candles ke saath move kar raha ho

- Volume support me ho

- Breakout / Breakdown clear ho

- News, result ya event ka directional impact ho

Matlab: Market rukne wali nahi hai

Best Choice: Debit Spreads

- Bullish View → Bull Call Spread

- Bearish View → Bear Put Spread

Logic (Beginner-Friendly)

- Debit spreads directional speed par kaam karti hain

- Profit tab banta hai jab price jaldi target ki taraf move kare

- Time decay (Theta) ka pressure kam hota hai

Simple Example (Bullish)

- Nifty strong breakout ke baad upar bhag raha hai

- Aap Bull Call Spread lagate ho

- Agar price fast upar gaya → spread ka value jaldi badhega

- Jaldi profit booking possible

Isliye jab confidence high ho, toh Debit Spreads best hoti hain

Case 2: Low Confidence / Slow Trend (Gradual Move)

Market Situation

- Price dheere-dheere move kar raha ho

- Trend weak ho, candles chhoti ho

- Market me confusion ho

- Direction sahi lag rahi ho, lekin speed kam ho

Matlab: Market zyada bhagne wali nahi hai

Best Choice: Credit Spreads

- Bullish View → Bull Put Spread

- Bearish View → Bear Call Spread

Logic (Beginner-Friendly)

- Credit spreads ko Theta Decay ka benefit milta hai

- Market agar dheere chale ya sideways rahe → profit automatically grow hota hai

- Price ko sirf safe zone ke andar rehna hota hai

Simple Example (Bearish)

- Nifty thoda weak hai, par crash ka signal nahi

- Aap Bear Call Spread lagate ho

- Agar price dheere niche aaye ya sideways rahe → premium decay se profit

Isliye jab confidence low ho, credit spreads zyada safe hoti hain

One-Line Rule for Beginners

Fast move expect ho → Debit Spread

Slow ya unclear move ho → Credit Spread

9. Option Greeks ka Role in Directional Strategies

Greeks ke bina directional trading andhere mein teer chalane jaisa hai.

9.1 Delta: Directional Strength ka Indicator

Delta batata hai ki Nifty ke move hone par aapka spread kitna move karega. Spreads mein hum Net Delta monitor karte hain jo naked options ke muqable kam volatile hota hai.

9.2 Theta aur IV ka Double-Edged Sword

Directional buying mein Theta dushman hai, lekin spreads mein hum Theta ko balance kar dete hain. Implied Volatility (IV) ka badhna aapke debit spreads ke liye faydemand hota hai.

10. Capital Allocation & Risk Management

- Lot Size Discipline: Nifty ke 65 lot size ko dhyan mein rakhte huye hamesha small quantity se shuru karein.

- One-Direction Rule: Ek din mein Bullish aur Bearish dono banne ki koshish na karein. Ek clear trend pakdein aur us par tike rahein.

11. Beginners ke Common Mistakes

- Ego Trading: Market ke against jana aur loss-making directional trade ko average karna.

- Chasing Momentum: Jab move nikal jaye tab entry lena (FOMO), jisse aapka stop-loss bohot bada ho jata hai.

12. Directional Trading Roadmap

- Trend Analysis: Daily aur Hourly chart par trend samjhein.

- Strategy Selection: View ke hisab se Bull ya Bear spread chuney.

- Risk Audit: Trade lene se pehle max loss check karein.

- Review: Har Tuesday Expiry ke baad apne trades ka analysis karein.

13. Summary & Final Guidance

Directional option trading ka matlab sirf market ki direction guess karna nahi hota, balki calculated risk ke saath planned decision lena hota hai.

Successful traders hamesha single option buying ke bajay spreads ka use karte hain, taaki risk pehle se defined rahe.

Greeks jaise Delta, Theta aur Vega samajhna zaroori hai, kyunki ye batate hain ki price, time aur volatility aapke trade ko kaise affect karenge.

Market momentum ke hisaab se debit ya credit spread choose karna discipline ka hissa hai, emotions ka nahi.

Har trade me entry, exit aur max loss pehle decide karna professional approach hoti hai.

Yaad rakhiye, consistency lucky calls se nahi, process aur discipline se aati hai.

Agar market clear direction na de, ya aap time decay ka fayda uthana chahte ho, toh agla logical step hai Non-Directional Option Strategies ko samajhna. jise humne ek alag article me cover kiya hua hai.

Yahan se padhiye: Best Non-Directional Option Strategies: The Ultimate A-Z Guide for Beginners

FAQs – Directional Option Strategy for Beginners

Bullish strategy market upar jane par profit deti hai, bearish strategy market niche jane par.

Aggressive move ke liye Bull Call Spread aur slow move ke liye Bull Put Spread behtar hai.

Jab aapko lagta hai market ek specific target par jaakar ruk jayega.

Ziadatar Theta decay ya fir entry ke waqt bohot high premiums pay karne ki wajah se.

Jab Nifty apni range break karke trend confirm kare.