1. Introduction

Imagine kijiye, Nifty 26,000 par trade kar raha hai aur aapko dikhta hai ki dono side (Call aur Put) ke premiums milakar aapko ₹300 se zyada mil rahe hain. Ek beginner ke liye ye “Easy Money” lagta hai—sirf bech do aur baith jao! Lekin yahi wo trap hai jahan retail traders fas jate hain.

Beginners ko lagta hai ki market hamesha sideways hi rahega, par wo bhul jate hain ki Short Straddle Option Strategy ek do-dhari talwar hai. Confusion tab shuru hoti hai jab market achanak ek side 200 point ka move de deta hai aur aapka MTM (Profit/Loss) tezi se lal hone lagta hai. Is article mein hum is “Easy Money” myth ko decode karenge aur seekhenge ki kaise Professional Traders is strategy ko ek disciplined business ki tarah treat karte hain.

Promise: Is deep-dive ke khatam hone tak, aapko pata hoga ki ATM options sell karne ka sahi waqt kab hai aur kab ise touch bhi nahi karna chahiye.

Kya aap jaante hain ki Short Straddle mein aapka profit fix hai lekin dukh (loss) unlimited? Toh phir log ise karte hi kyun hain? Jawab hai—Probability.

2. Short Straddle Option Strategy Kya Hoti Hai?

Short Straddle ek aisi strategy hai jahan ek trader ek hi Strike Price (jo ki usually At-the-money hota hai) ka Call aur Put dono sell kar deta hai.

2.1 Short Straddle Ka Basic Structure Hinglish Me

Agar Nifty 26,000 par hai, toh aap:

- 26,000 CE (Call Option) sell karenge.

- 26,000 PE (Put Option) sell karenge.

Aapka view ye hai ki market Tuesday Expiry tak 26,000 ke aas-paas hi rahega.

2.2 ATM Options Sell Karne Ka Core Logic

ATM (At-the-money) options mein Intrinsic Value sabse zyada hoti hai. Jab aap inhen sell karte hain, toh aap basically Theta Decay (Time value) par bet laga rahe hain. Kyunki Nifty ki expiry ab Tuesday ko hoti hai, Monday aur Tuesday ko ye ATM premiums makkhan ki tarah pighalte hain, jo seller ka profit hota hai.

3. Short Straddle Non-Directional Strategy Kyun Mani Jati Hai?

Ismein aapka koi directional bias nahi hota. Aap “Neutral” hote hain.

3.1 Market Neutral Expectation Ka Meaning

Iska matlab hai ki aap market ke “Movement” ko nahi, balki uske “Shanti” (Quietness) ko trade kar rahe hain. Nifty 26,000 se 50 point upar jaye ya niche, jab tak wo aapke Breakevens ke andar hai, aap safe hain.

3.2 Price Stability Ka Role

Straddle tab profit deta hai jab price ek narrow range mein stable rahe. Agar market Institutional Order Blocks ke beech phasa hai, toh ye stability seller ke liye sona hai.

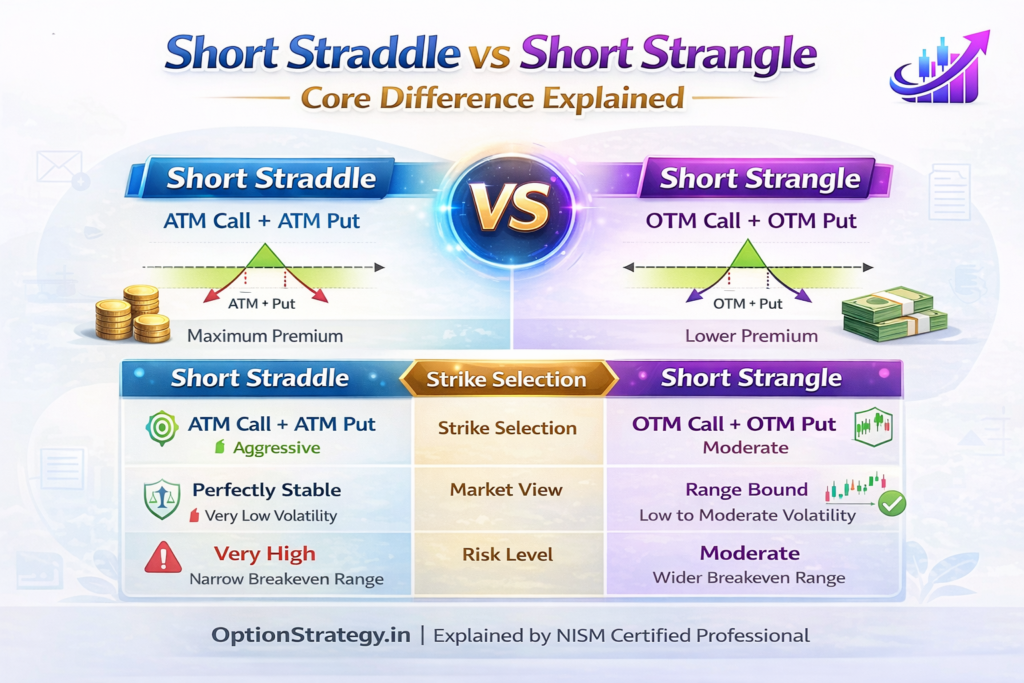

4. Short Straddle And Short Strangle Me Core Difference Kya Hai?

Ye dono cousin strategies hain, par inka “Risk Appetite” alag hai.

| Feature | Short Straddle | Short Strangle |

| Strike Price | ATM (Same Strike) | OTM (Different Strikes) |

| Premium Collected | Very High (Maximum) | Lower |

| Safety Range | Narrow (Choti Range) | Wide (Badi Range) |

| Probability of Profit | Lower (per trade) | Higher |

Short Strangle mein aap dur ke strikes bechte hain (e.g., 25,700 PE and 26,300 CE), jabki Straddle mein aap aag ke bilkul paas hote hain.

Agar Straddle itna risky hai, toh bade institutions ise Nifty 26,000 ke level par kyun deploy karte hain? Jawab chupa hai IV Crush mein.

5. Execution Math: Nifty 26,000 Short Straddle (Lot Size: 65)

Chaliye, real numbers ke sath dekhte hain ki Tuesday Expiry ke liye calculation kaise hoti hai.

The Execution Blueprint:

- Current Market Price (CMP): 26,000

- Sell 26,000 CE @ ₹180

- Sell 26,000 PE @ ₹170

Final Math Table:

| Component | Calculation Details | Final Value |

| Total Premium Collected | ₹180 (CE) + ₹170 (PE) | +₹350 |

| Max Profit Per Unit | ₹350 (If ends at 26,000) | ₹350 |

| Max Profit Per Lot | ₹350 x 65 (Lot Size) | ₹22,750 |

| Upper Breakeven | 26,000 + 350 | 26,350 |

| Lower Breakeven | 26,000 – 350 | 25,650 |

| Max Risk | No Limit (Theoretical) | High Alert |

6. Indian Market Context: Kab Zyada Use Hoti Hai?

India mein Nifty Tuesday Expiry ne is strategy ka dynamics badal diya hai.

6.1 Event-based Trading & IV Crush

Bade events (Budget, RBI Policy) se pehle Implied Volatility (IV) badh jati hai, jisse premiums mehnge ho jate hain. Jaise hi event khatam hota hai, IV crash hoti hai aur ₹300 ka Straddle achanak ₹150 ho jata hai. Ise kehte hain Volatility Crush.

6.2 Weekly Expiry Behaviour

Professional traders aksar Monday sham ko entry lete hain taaki Tuesday subah ka Theta Decay capture kar sakein. Lekin yaad rakhiye, Tuesday ko Gamma Risk sabse zyada hota hai—ek chota move aur premium double!

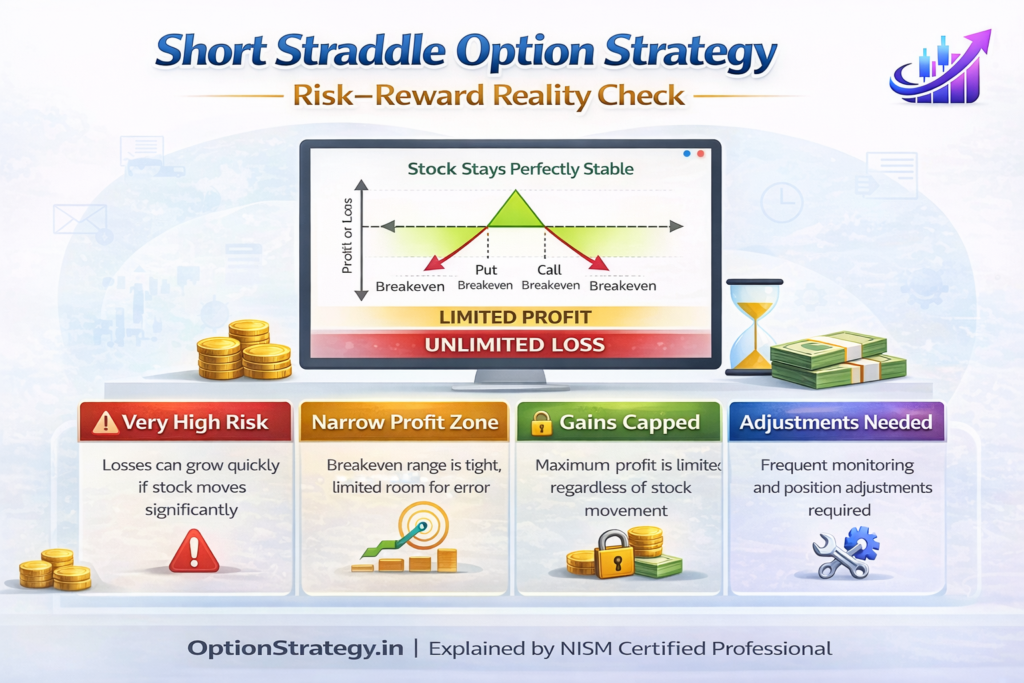

7. Short Straddle Ka Risk–Reward Reality Check

Unlimited loss ka matlab ye nahi ki aapka ghar bik jayega, iska matlab hai ki aapko Adjustments mein expert hona padega.

- Practical Meaning: Agar Nifty 26,000 se seedha 26,500 nikal gaya, toh aapka Call side ka loss aapke Put side ke profit se kahin zyada bada hoga.

- Gamma Risk: Expiry ke din (Tuesday) options ke prices bahut “Jumpy” hote hain. Isliye beginners ko expiry ke din ATM Straddle avoid karni chahiye.

Kya aap jaante hain ki 90% beginners adjustment na hone ki wajah se capital wipe-out kar dete hain?

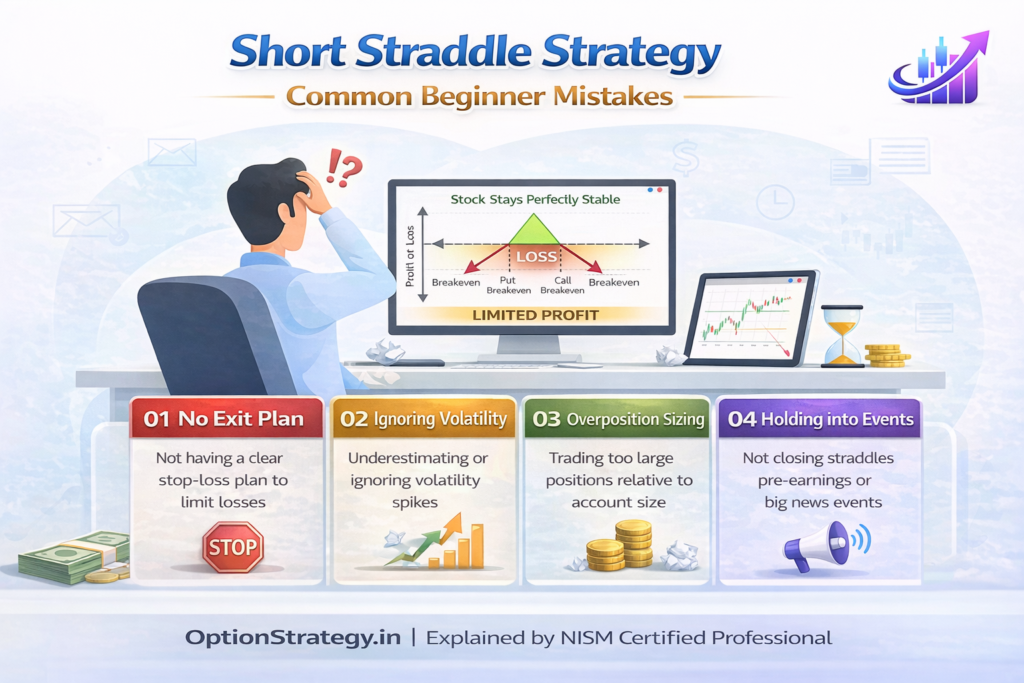

8. Short Straddle Strategy Ke Common Beginner Mistakes

- Chasing High Premium: Sirf isliye sell karna kyunki ₹400 mil rahe hain. Aksar high premium ka matlab hota hai market bada move expect kar raha hai.

- No Adjustment Plan: Log tab sochte hain jab loss haath se nikal jata hai. Ek pro-trader hamesha Short Straddle Adjustment Strategies ke saath enter karta hai.

- Over-Leveraging: Margin kam lagane ke liye “Naked Selling” karna bina backup capital ke.

9. Kis Type Ke Trader Ke Liye Suitable Hai?

- Full-Time Traders: Jinhe screen ke samne baithkar har minute Delta monitor karne ka waqt hai.

- Capital Requirement: Kam se kam ₹2-3 Lakh per lot (Adjustments ke liye extra margin zaroori hai).

- Working Professionals: Inke liye ye strategy risky hai. Inhen hamara Iron Fly Option Strategy guide dekhna chahiye jo Straddle ka hedged version hai.

10 Tools & Platforms for Short Straddle Option Strategy

Short Straddle ek high-risk, high-reward non-directional option strategy hai jisme accurate range prediction, IV analysis aur strict risk control zaroori hota hai. Neeche diye gaye tools aapko strike selection, payoff clarity aur event risk management me help karte hain.

10.1 Option Strategy Builder & Payoff Analysis

Short Straddle me exact breakeven, max loss aur adjustment planning bina tool ke possible nahi hoti.

- Sensibull – Short Straddle payoff chart, Greeks (Delta, Gamma, Vega) aur adjustment simulation ke liye

- Opstra – Probability of profit, IV percentile aur strategy comparison ke liye advanced analytics

Note :- Short Straddle execute karne se pehle payoff visualization mandatory rakhein.

10.2 Implied Volatility (IV) & Greeks Monitoring Tools

Short Straddle tab best kaam karti hai jab IV high ho aur expected move limited ho.

- NSE India Option Chain – ATM strikes ki IV, OI aur OI change check karne ke liye

- TradingView – India VIX, index structure aur support-resistance confirmation ke liye

10.3 Event Risk & News Tracking Tools (Most Critical)

Short Straddle me events sabse bada enemy hote hain (gap risk).

- Economic Calendar – Policy decisions, inflation data aur global events track karne ke liye

- Moneycontrol – Market news, volatility triggers aur sentiment overview

10.4 Broker Platforms & Margin Calculators

Short Straddle me margin requirement high hoti hai, isliye pehle margin verify karna zaroori hai.

- Zerodha – Margin calculator aur fast execution

- Upstox – Option chain view, basket order aur risk monitoring

Risk Disclaimer

Short Straddle bina hedge ke unlimited loss strategy hai. Tools sirf analysis me madad karte hain, risk eliminate nahi karte.

11. Summary: Kab Avoid Karna Smart Hota Hai?

Short Straddle tab avoid karein jab:

- Market Trending ho (Strong Higher-Highs pattern).

- India VIX 12 se niche ho (Premium bohot kam milenge).

- Aapke paas automatic Stop-loss system nahi hai.

Strategic Conclusion:

Short Straddle options trading ka “Formula 1” car hai. Speed (Profit) bohot hai, par agar brake (Stop-loss) fail hua toh accident bada hoga. Hamesha hedged strategies se shuru karein aur experience ke baad hi naked straddles par aayein.

FAQs: Short Straddle Mastery

Nahi. Kyunki ismein unlimited risk hota hai, beginners ko hamesha Iron Fly (Hedged Straddle) se shuruat karni chahiye.

Main difference strike price ka hai. Straddle mein hum ATM bechte hain (Zyada premium, Kam range), jabki Strangle mein hum OTM bechte hain (Kam premium, Zyada range).

Kyunki expiry day (Tuesday) par Theta Decay sabse fast hota hai, jisse sellers ko kam waqt mein zyada profit milne ke chances hote hain.

Kyunki aapne Call aur Put dono sell kiye hain, agar market kisi bhi ek direction mein bohot bada move (breakout/crash) de de, toh us side ka premium unlimited badh sakta hai.

High volatility ka matlab hai market bade moves le sakta hai. Aise mein Straddle ki narrow range jaldi breach ho jati hai aur losses tezi se badhte hain.